OCR Automated Insurance Operations with AI-driven OCR Technology: From Manual Entry to Digital Precision

Brief

An advanced AI-OCR solution designed to automate the extraction of data from claims and policy documents, slashing processing times and error rates for insurance providers.

I. Challenges:

Key barriers the client faced before automating their document workflows. The client, a leading company in the insurance industry, was struggling with the significant operational burden of manual data entry. With thousands of claims forms, policy agreements and identity documents flooding in daily, their workforce was overwhelmed. Manual processing was not only slow but also financially draining, with errors costing the business millions each year.

However, the sheer variety of document formats, ranging from handwritten forms to scanned PDFs, made standard automation difficult. They needed a solution capable of “reading” diverse inputs with human-like understanding but machine-like speed. The problem? Their legacy manual processes had a 90% error risk, causing significant bottlenecks during high-demand periods such as open enrollment. That’s when they turned to Adamo.

What challenges do they deal with?

II. How Adamo delivered the AI-OCR Transformation

To resolve the bottlenecks of manual entry and data fragmentation, Adamo developed a tailored Optical Character Recognition (OCR) system powered by Computer Vision and NLP. The objective was to build a pipeline that doesn’t just “read” text, but understands, verifies and structures it for immediate business use.

1. Tailored OCR Engine with DBNet & PyTorch

Adamo designed a custom OCR architecture trained on specific insurance datasets. By utilizing DBNet for text detection and PyTorch for deep learning, the model enables high-precision extraction of both typed and handwritten text from complex layouts. This ensures that even low-quality scans or irregular handwritten forms are processed accurately, capturing critical datapoints without manual intervention.

2. Intelligent Data Verification & Logic Layer

Beyond simple text extraction, Adamo implemented a logic layer that validates the data against industry standards. The system performs “Verify Datapoints” checks immediately after extraction. This includes verifying signatures, matching policy numbers against database records, and ensuring dates are valid. This automated validation step reduced error rates by 40% immediately upon deployment.

3. Scalable Cloud Automation on AWS

To handle the fluctuating volume of insurance claims, especially during peak seasons, the solution was deployed on a scalable AWS infrastructure. This allows the system to automatically scale processing power based on the volume of uploaded Zip or Batch files. This ensures that whether the client processes 100 or 10,000 documents, the speed remains consistent and eliminates bottlenecks.

III. Key Features of the AI-powered internal chatbot

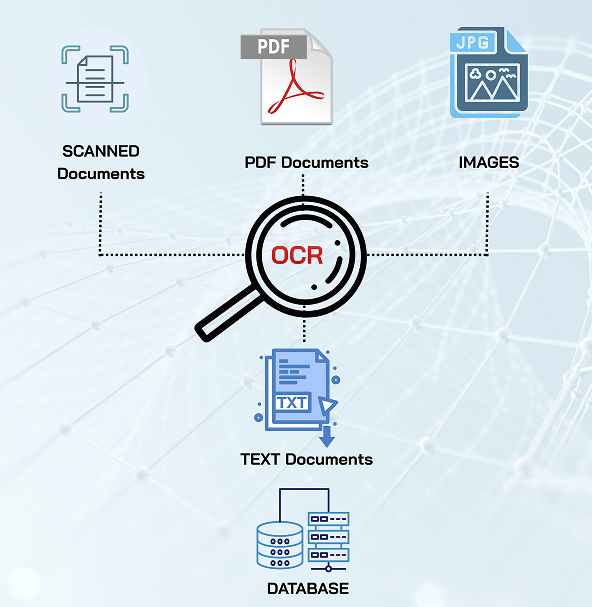

1. Multi-Format Ingestion: Automatically processes diverse inputs, including PDFs, images, and scanned pages from Zip files.

2. AI Text Extraction (Handwritten & Typed): Uses Computer Vision to accurately read and digitize text from varied fonts and handwriting styles.

3. Smart Signature Verification: Automatically detects and verifies the presence and validity of signatures on claim forms.

4. Automated Datapoint Validation: Cross-checks extracted data (names, dates, policy IDs) against logic rules to ensure accuracy and consistency.

5. JSON Structural Output: Converts unstructured document data into clean, machine-readable JSON responses for easy system integration.

6. High-Volume Batch Processing: Capable of unzipping and processing massive batches of documents simultaneously without lag.

7. Compliance-Ready Digital Archiving: Organizes digitized data to meet regulatory standards for audit trails and data security.

8. Underwriting Automation Support: Feeds verified data directly into underwriting models, accelerating risk assessment.

IV. A Zero-Touch Data Ecosystem for Insurers

By implementing Adamo’s advanced OCR solution, the client successfully transformed their operations from a manual bottleneck into a streamlined digital workflow. The system now handles peak loads effortlessly, eliminating the backlog during open enrollment seasons. With effective validation checks, data reliability has significantly improved, reducing error rates by over 40% and minimizing the risk of claim disputes. Ultimately, the transition to AI-driven processing has empowered the client to process claims in real-time, drastically improving customer satisfaction and operational compliance.

Learn More

Learn More

Web

F&B

AI

AU