Learn More

Learn More

-

Mobile

-

Healthcare

-

AI

-

US

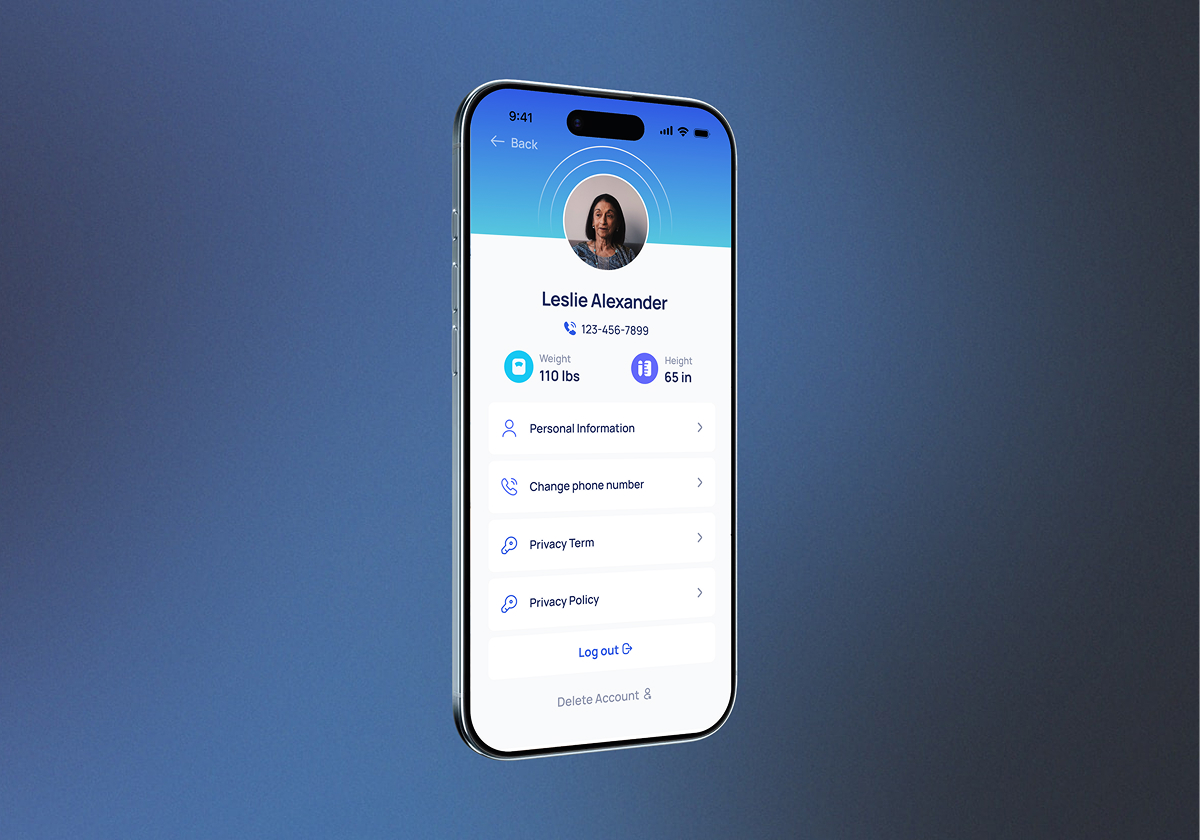

ONEai Health

Partnered with Adamo, this platform uses real-time biometric data to empower healthcare providers, cut readmissions, and transform chronic disease management.