Technical expertise

We build secure, scalable payment apps that integrate seamlessly with your systems.

Top Services

Advanced Technologies

Home

Finance Technology Solutions

Payment Solutions

Real-time payment processing with scalable digital solutions.

OVERVIEW

Nearly 3 trillion transactions, totaling $48 trillion, are set to shift from cash to real-time and electronic payments this decade. The leaders in digital payments aren’t waiting for change – they are seizing first-mover advantage to evolve their businesses, and we help firms join them. Powered by AI, blockchain, and machine learning, our payment platforms improve processing speed, operational efficiency, and long-term scalability.

Core capabilities include:

KEY MODULES

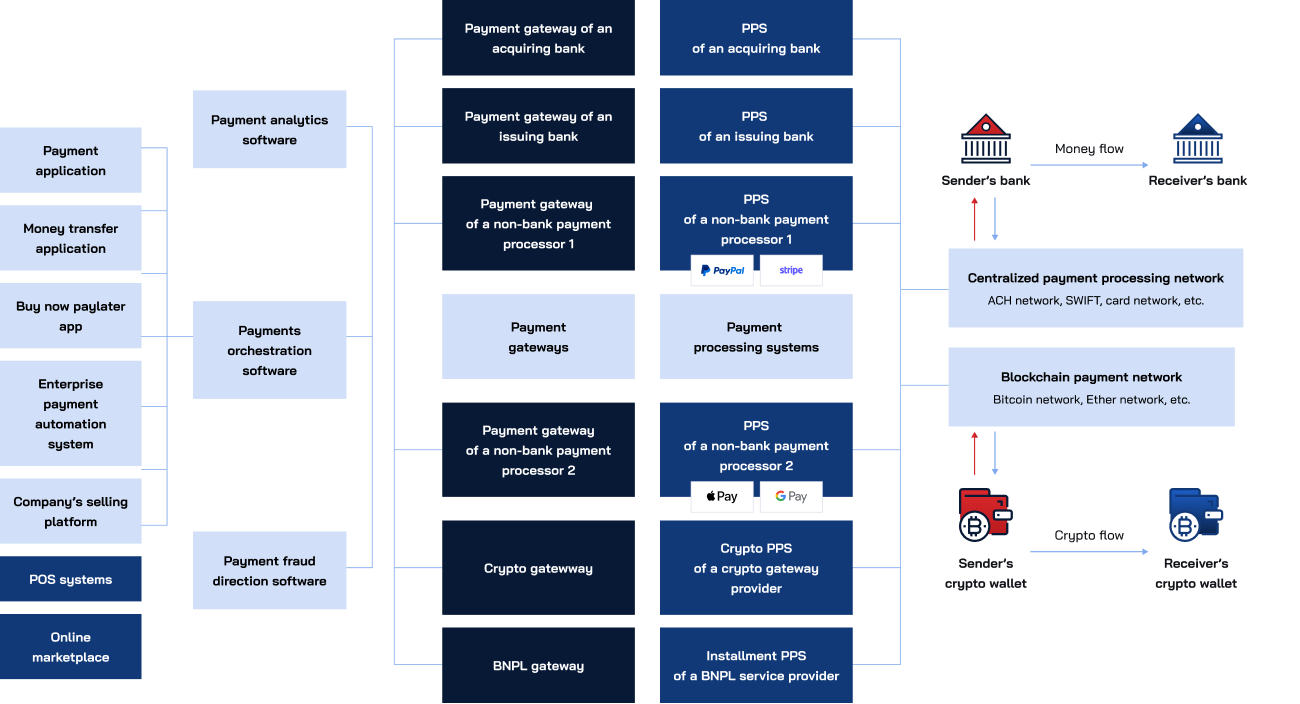

Build secure e-wallet apps that enable fast digital payments, real-time transfers, and cross-bank transactions. With intuitive design, strong encryption, and instant processing, your users can pay anytime, anywhere with confidence.

Create peer-to-peer payment platforms that deliver fast, low-cost money transfers beyond traditional banking. Backed by fintech expertise, our solutions ensure secure processing, high performance, and smooth user experiences.

Design a secure, flexible payment gateway with seamless API integrations to fit your needs. Scale transactions smoothly, personalize payment experiences, and gain actionable insights through built-in analytics.

Manage sales and customers with POS solutions built around your unique workflows and business needs. Scale with confidence using secure payment processing, real-time data, and centralized dashboards that give you full visibility across every transaction.

Enable secure, efficient payment processing by managing verification, authorization, and settlement end to end. Support cards, e-wallets, bank transfers, and other digital payment methods at scale.

Prevent payment fraud by monitoring transactions and detecting suspicious activity through advanced data analysis. Reduce risk and protect your business with intelligent fraud prevention built for secure payment processing.

Integrate multiple sales channels with various payment service providers through a unified processing system. Aggregate omnichannel transactions in real time and use analytics-driven routing to direct each payment to the most suitable processor for optimal performance and cost efficiency.

Manage recurring payments as subscription models grow by automating billing and subscription management in a single system. Gain actionable customer insights through advanced analytics to power targeted marketing and retention strategies.

Allow customers to take home purchases and pay in installments with the Buy Now, Pay Later platforms. Deduct payments automatically from their selected card while boosting engagement and satisfaction for those who prefer spreading out their expenses.

Provide customers with cryptocurrency payment options through secure wallet and exchange solutions. Store, manage, and exchange digital currencies efficiently while increasing transparency, reducing risk, and streamlining transactions.

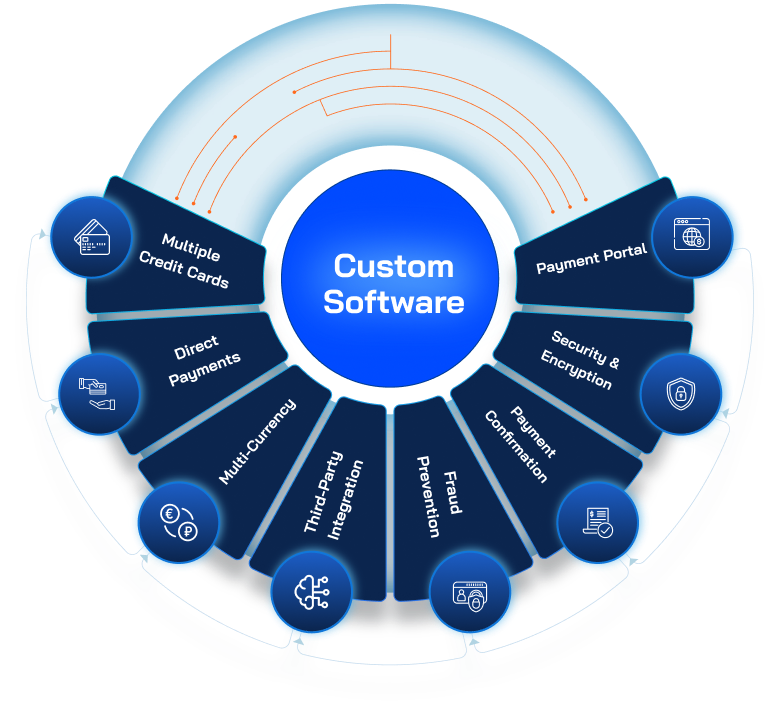

CUSTOM PAYMENT SOLUTIONS

BENEFITS

Protect payments with tokenization, encryption, SSL, and other advanced security measures.

Accelerate refund processing for a smoother customer experience.

Streamline invoicing with better tracking, reduced paperwork, and online accessibility.

Analyze transaction data to gain actionable insights into customer behavior and drive acquisition and retention.

WHY ADAMO

We build secure, scalable payment apps that integrate seamlessly with your systems.

Encryption, tokenization, and PCI DSS compliance protect sensitive financial data.

Personalized solutions and ongoing support ensure user satisfaction and long-term value.

We connect payment platforms with gateways, CRMs, and databases for smooth operations.

HOW PAYMENT SOFTWARE SOLUTIONS WORK

INDUSTRIES

ADVANCED TECHNOLOGY ADOPTION

IoT enables secure, contactless payments using NFC chips, sensors, and connected devices.

AI enhances fraud and AML detection, personalizes experiences, improves approvals, and reduces declines.

Blockchain cuts fees and enables instant, trusted, intermediary-free transaction verification.

Cloud powers secure, scalable payment processing with real-time access and lower operational costs.

FAQ

The time it takes to build a payment gateway can vary significantly based on various factors, including the complexity of the gateway, the team’s expertise, the desired features, and the level of integration required. Building a payment gateway is a complex task that involves several critical aspects, such as security, compliance, and seamless integration with financial institutions and payment networks.

For a simple payment gateway with basic features and limited payment options, it might take a few months to develop and deploy. On the other hand, a more sophisticated and feature-rich payment gateway with support for multiple payment methods, international currencies, advanced security measures, and compliance with various regulatory requirements can take six months to a year or even longer.

There are three types of digital wallets such as closed wallets, semi-closed wallets and open wallets. Closed wallets refer to the payment approach that enables users to make transactions through mobile apps and web-based apps. Semi-closed wallets enable users to implement transactions at the selected merchants. Besides, open wallets allow customers to execute any payment transaction.

Adamo team adheres to cutting-edge data encryption, security protocols, and multi-factor authentication methods, alongside robust security measures, to safeguard the integrity and privacy of your financial data.

RESOURCE HUB