Learn More

Learn More

-

Web

-

Healthcare

-

AI

-

EU

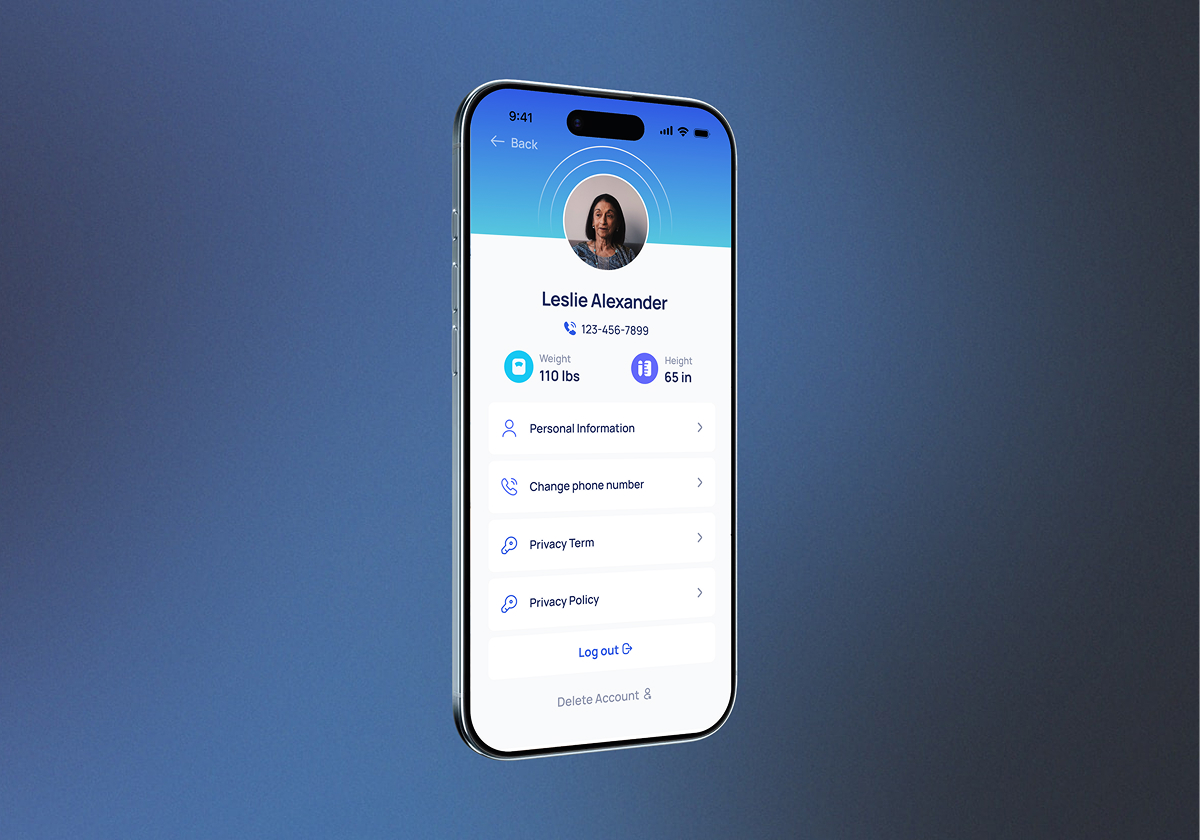

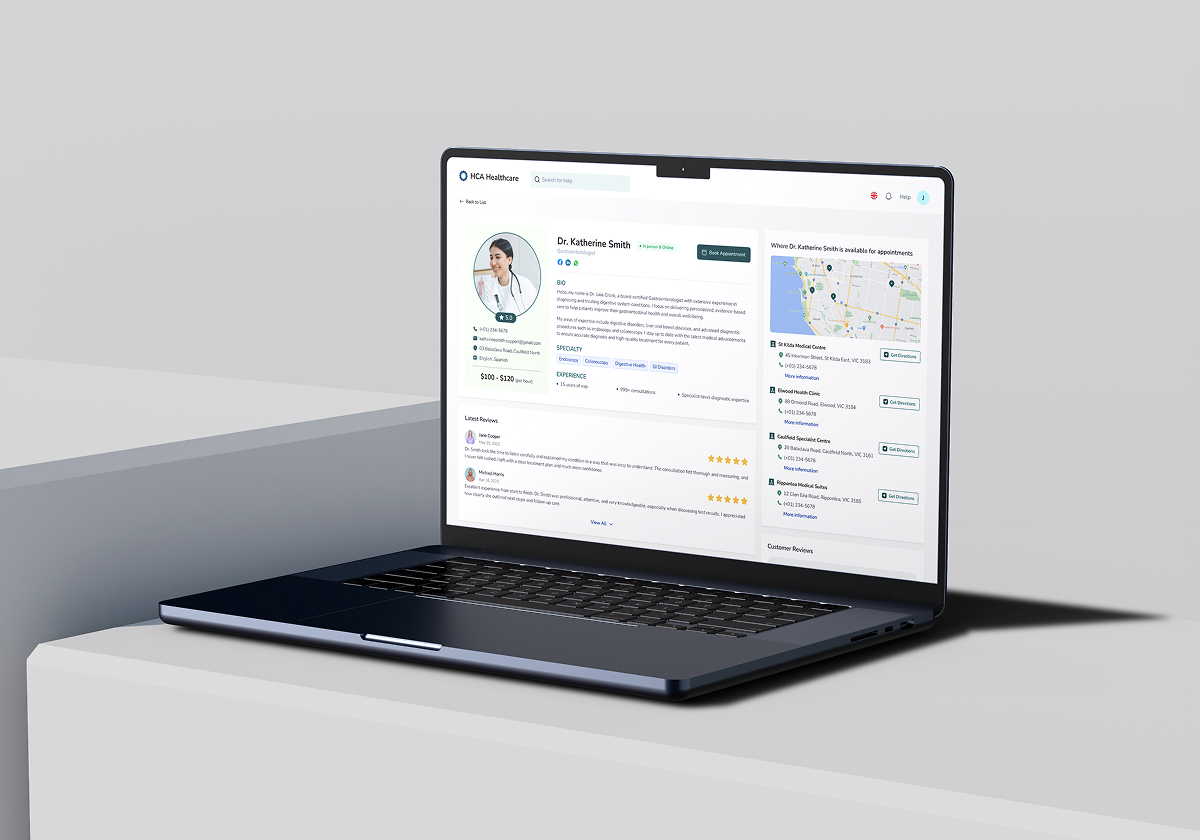

AI-enabled Mediverse Solution for Cross-functional Telehealth and Diagnostics

Developed by Adamo Software, the platform empowers healthcare providers to deliver fast, transparent, and patient-centric care.